There is no sense at all in keeping your assets liquid. Of course you should have an emergency fund, and you should have some of that savings put aside in precious metals (just in case). But what to do with the rest of it? You could buy property. You could invest in a classic exotic car (like we’ve talked about before). Or you could try your luck with the stock market.

Wall Street: Federally Endorsed Casino?

I know what you are thinking. The stock market is for professionals. People that don’t what they are doing in the stock market are as bad as people that don’t know what they are doing at a poker table. Normally I would agree with you. Leave the stock market to the people who study it. All those numbers, and stats and trends… Leave the math to the mathematicians. If God wanted me to know math, he wouldn’t have invented calculators… or I guess in my case, the computer and smart phone. (Does anyone own a stand alone calculator anymore?).

If my Computer can do Math for Me, Why Can’t it Pick Stocks?

Well guess what? It can. Well, kind of. You see, a while back a friend of mine told about this App called Fundlogik. It doesn’t exactly pick stocks for me, but it does tell me when to trade them. And it isn’t shaking a Magic 8 ball to do it. I am sure there is a more technical way to say this, but basically: the Fundlogik App uses some amazing high tech algorithms and super nerdy mathematical trend studying AI super computer brain to judge when you should buy or sell a particular stock. (ok it was designed for ETFs, but I used it for regular old stocks.) I picked a list of 17 stocks in a particular industry (you can picks as few or many as you like). I chose one industry because I believed in the industry, but didn’t know enough about the individual companies to know if their particular business plan was going to work or if they were headed for failure.

Well guess what? It can. Well, kind of. You see, a while back a friend of mine told about this App called Fundlogik. It doesn’t exactly pick stocks for me, but it does tell me when to trade them. And it isn’t shaking a Magic 8 ball to do it. I am sure there is a more technical way to say this, but basically: the Fundlogik App uses some amazing high tech algorithms and super nerdy mathematical trend studying AI super computer brain to judge when you should buy or sell a particular stock. (ok it was designed for ETFs, but I used it for regular old stocks.) I picked a list of 17 stocks in a particular industry (you can picks as few or many as you like). I chose one industry because I believed in the industry, but didn’t know enough about the individual companies to know if their particular business plan was going to work or if they were headed for failure.

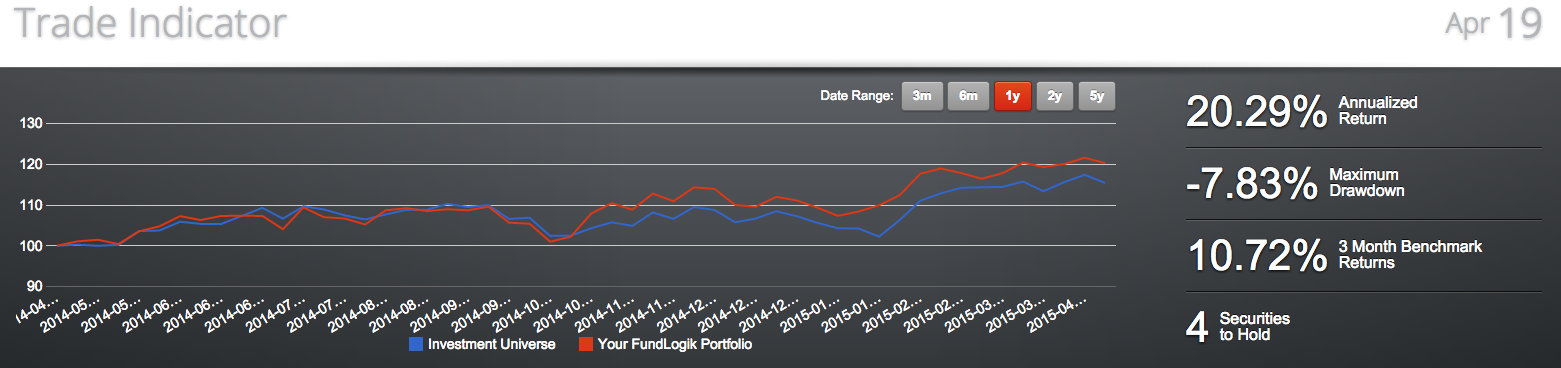

The Fundlogik App analyzed my 17 pics, and gave me a list of 4 to hold stock in. Every once in a while, the app would tell me to sell this and buy that (within my list of 17 companies), and I did. So how did Fundlogik do? Well look below to see.

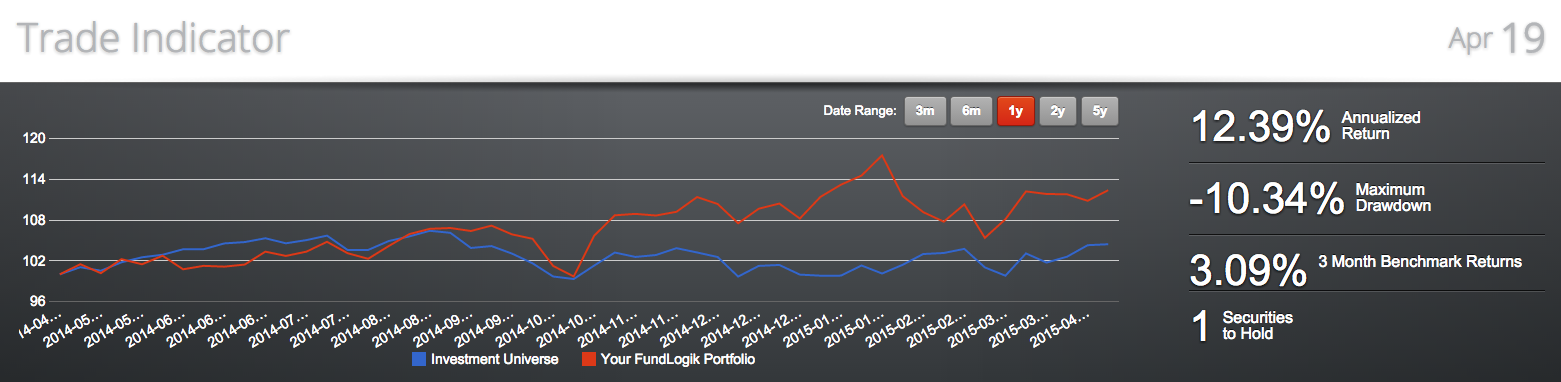

So if you paid attention to the current interest rate widget above, you can see that Fundlogik is blowing CD’s out of the water. 20% return is damn good. My portfolio is beating the market while the market is having an incredible year. That is pretty impressive if you ask me. Now I know you must be thinking that I got lucky. My portfolio isn’t going to perform like yours. Well, you could be right. But Fundlogik has a standard portfolio that they picked. It is available for any user to see, and it did a 12% return last year. Not as good as mine, but still far above current CD rates. Take a look at the standard Fundlogik “example” portfolio holding only one asset at a time:

The “example” porfolio is also beating the market. You could just stick to this one, and you would be making a good profit. So go ahead, step up to the table, and play the market. Just do it with computer calculating your odds for you. That is what they are good at.